Introduction to the W-9 Tax Form

What is a form W 9? Usually, it isn’t one you have to file by yourself. For most people, the procedure is done by their employer. But what to do if you’re, let’s say, a self-employed makeup artist, videographer or career coach? Then filing out W9 tax Form is a must.

If your jobs and gigs land you at least more than $600 annually — IRS Form W-9 must be submitted to the office. Otherwise, you’ll face financial penalties.

All independent contractors are obliged to do so. And if you’re searching for a Form W-9 printable — you’re in luck! Our platform will provide you with the blank template, Form W-9 instructions and a few valuable tips to secure your personal safety.

Not much of a brainer! Just use our free W-9 tax form and be done with it. Or, if you have little time, you can outsource the tax chores to the professional team.

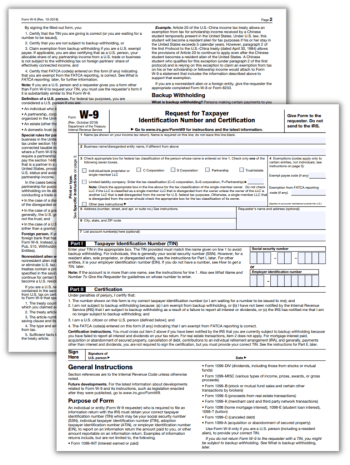

Filing Out Form W-9: Step-by-Step Instruction

- First, download W-9 form.

- Provide your TIN — Social Security Number will do.

- Write in your ‘government’ name.

- Enter your ‘disregarded entity’ name. In other words, brand/alias you’re doing the business under.

- Pick the tax classification.

- Check if you qualify for exemptions.

- Detail your whereabouts.

Why Fill Out & File the W-9 Form

There are many different situations in which individuals must use a form. Here are two examples of individuals who may be required to use a form, along with detailed descriptions of these fake individuals:

- Example 1: John Smith is a 35-year-old self-employed contractor who is required to fil out a form to file his annual taxes. John has been working as a contractor for the past 10 years, and he has a small business that provides services such as home renovations and landscaping. In order to accurately report his income and expenses, John must use a form to document all of his financial transactions over the course of the year.

- Example 2: Sarah Johnson is a 22-year-old college student who is required to use a form to apply for financial aid. Sarah is currently enrolled in a four-year degree program at a local university, and she relies on financial aid to help pay for her tuition and other expenses. In order to be considered for financial aid, Sarah must complete a W-9 form that includes information about her academic background, financial need, and other relevant details.

In both of these examples, the individuals are required to use a W-9 federal form in order to provide accurate and complete information about their circumstances. In the first example, John must use a W-9 form to properly report his income and expenses, while in the second case, Sarah must file a W-9 form to give information about her financial need and academic background.

Possible Punishment

Just like in court, in fillable Form W9, you must say only truth. False information is punishable by a $500 fine. Providing incorrect TIN info is also forbidden. This time you’ll pay only $50. But remember: each TIN failure is punished separately. The worst thing that can happen is imprisonment for ‘willfully falsifying certifications.’

When to File the W-9 Form

The form W-9 instructions state that it must be filed and submitted by January 31. It means, that the DOC is basically in the same category as 1099-MISC forms. But we recommend you prepare and submit it in advance.

The thing is: indie-contractors show a tendency to procrastinate when it comes to taxes. If you prefer sending W9 form by mail, you risk dealing with a mass panic. Especially during the last days before the deadline. We suggest you file Form W-9 online or let the experts handle it.

More Tips for Taxpayers

- Ensure that all of the information provided on the W-9 form is accurate and up to date. Double-check everything, including your name, address, Social Security Number, and other required information.

- Make sure you are familiar with the different types of taxpayer identification numbers. Individuals should use their SSN, while organizations such as trusts and estates must use an Employer Identification Number.

- Before you file the W-9 form, verify that the company you are dealing with is a legitimate business. If you are unsure, contact the IRS to confirm the entity's status.

- Read all instructions carefully and follow them precisely. Many of the sections on the W-9 form require that you check a box or select a response. Make sure that you select the appropriate option for your situation.

IRS Form W-9: Most Common Questions

- What is the form W 9 purpose anyway?It is mandatory for all full-time employees and independent contractors. The doc verifies your persona, so you can legally receive income from whatever you do. Besides, W 9 blank Form is often requested to detail info on any revenue that isn’t job-related: dividends from investing, real estate deals, etc.

- Do I have to file the W-9 form upon every request?Actually, you don’t. Sometimes, a W-9 form can be used for fraud purposes: it contains such sensitive info as Social Security Number, EIN, etc. So, if you’re asked by someone who is not your client to file a W-9 — it is suspicious. Only people/companies who hire you can request it. If you’re a full-time employee, you mustn’t file W-9 either. Instead, your boss should provide you with a standard W-4 form.

- Where can I get the W-9 form blank for free?On our website! Here you can download W-9 form in PDF. It’s an absolutely valid copy of the document. After filling the form, that you can either print it and send to the IRS office via USPS. Remember: the mailing address differs, depending on your current location. Or you can handle the job digitally, which is more time-saving.

- Are there instructions for completing the W-9 form?Yes, the IRS website provides detailed instructions on how to complete a W-9 form. These instructions can be found online and are also included in the printable versions of the form. Additionally, the fan website that provides information about the W-9 form may also have additional instructions and information.

- When is a W-9 form required?The W-9 form is usually required when a taxpayer is hired by a company or receives income from a third-party payer. This form is used to collect information on the taxpayer's name, address, and TIN so the payer can accurately report any income paid to the taxpayer on their tax return.

IRS Form W-9 Versions

-

![image]() Form W-9 Online The W-9 tax form is a crucial document for independent contractors and other individuals who receive income from sources other than traditional employment. It is used to provide their taxpayer identification number (TIN) and certify their tax filing status to the payer of the income. In 2021, the In... Fill Now

Form W-9 Online The W-9 tax form is a crucial document for independent contractors and other individuals who receive income from sources other than traditional employment. It is used to provide their taxpayer identification number (TIN) and certify their tax filing status to the payer of the income. In 2021, the In... Fill Now -

![image]() Form W-9 Printable The W-9 tax form is a document that taxpayers use to provide their tax identification information to employers or other entities for tax filing purposes. The printable version of the W-9 form is an easy-to-use way to provide the necessary information to the entity requesting it. The W-9 form includ... Fill Now

Form W-9 Printable The W-9 tax form is a document that taxpayers use to provide their tax identification information to employers or other entities for tax filing purposes. The printable version of the W-9 form is an easy-to-use way to provide the necessary information to the entity requesting it. The W-9 form includ... Fill Now