Fillable W-9 Form for Online Filing

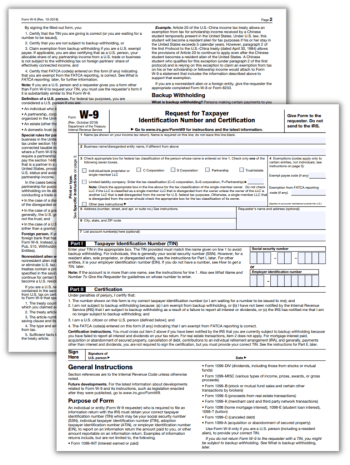

The W-9 tax form is a crucial document for independent contractors and other individuals who receive income from sources other than traditional employment. It is used to provide their taxpayer identification number (TIN) and certify their tax filing status to the payer of the income. In 2021, the Internal Revenue Service (IRS) introduced an online version of the form, which has several key features and advantages.

Features of the online version of the W-9 form

One of the main features of the online W-9 form is the ability to complete and submit the form electronically. This saves independent contractors the hassle of printing and mailing the form and reduces the risk of errors or omissions. The online form includes fields for all the required information, including the taxpayer's name, TIN, and tax filing status. It also has a certification statement that the taxpayer must sign to confirm the accuracy of the information provided.

Another key feature of the online W-9 form is the ability to update the form anytime during the year. In the past, independent contractors had to wait until the beginning of the next tax year to change their W-9 form. The online version allows them to make changes at any time, which can be especially useful if their financial situation or tax filing status changes.

Pros of completing and filing the form online

There are several advantages to using the online W-9 form. One advantage is that it is more accurate than the paper version. Independent contractors can complete the form at their own pace and review their information before submitting it, which reduces the chances of errors or omissions. This can help to avoid issues with the IRS or payers of income in the future.

Another advantage is that the online form is more convenient and easier to use than the paper version. Independent contractors can complete the form from any device with an internet connection and access the form at any time of day or night. The form also includes helpful explanations and tips to guide independent contractors through the process.

Where to find the online W-9 form?

There are several ways to access the online W-9 form:

- Independent contractors can find the form on the IRS website or the website of the payer of their income.

- There is also an ability to access the form through the tax preparation software or mobile app.

In conclusion, the online W-9 tax form is a helpful tool for independent contractors and individuals who receive income from sources other than traditional employment. Its key features and advantages, including the ability to complete and submit the form electronically and update the form anytime, make it an accurate and convenient way to provide their TIN and certify their tax filing status to the payer of their income. Independent contractors can access the form through the IRS website, the website of the payer of their income, or their tax preparation software or mobile app.

Related Forms

-

![image]() Form W-9 What is a form W 9? Usually, it isn’t one you have to file by yourself. For most people, the procedure is done by their employer. But what to do if you’re, let’s say, a self-employed makeup artist, videographer or career coach? Then filing out W9 tax Form is a must. If your jobs and gigs land you at least more than $600 annually — IRS Form W-9 must be submitted to the office. Otherwise, you’ll face financial penalties. All independent contractors are obliged to do... Fill Now

Form W-9 What is a form W 9? Usually, it isn’t one you have to file by yourself. For most people, the procedure is done by their employer. But what to do if you’re, let’s say, a self-employed makeup artist, videographer or career coach? Then filing out W9 tax Form is a must. If your jobs and gigs land you at least more than $600 annually — IRS Form W-9 must be submitted to the office. Otherwise, you’ll face financial penalties. All independent contractors are obliged to do... Fill Now -

![image]() Form W-9 Printable The W-9 tax form is a document that taxpayers use to provide their tax identification information to employers or other entities for tax filing purposes. The printable version of the W-9 form is an easy-to-use way to provide the necessary information to the entity requesting it. The W-9 form includes vital features such as name and address, Social Security Number, Employer Identification Number (EIN) in case of a business, type of entity, and certification. The form also requires the taxpayer to provide their signature and the date of signature. Advantages of the printable version The advantages of using the printable version of the W-9 form include the following: being able to print the form on demand; being able to save the form for future use; being able to complete the form without having to worry about making any mistakes; the form is also easy to use and can be filled out in minutes. The W-9 form can be obtained in several ways. Taxpayers can simply download the form from the Internal Revenue Service (IRS) website or obtain the form from their employer. It is also possible to obtain the form from a tax professional or legal representative. How to fill out the W-9 form? In order to complete the W-9 form properly, taxpayers should ensure they provide all the necessary information accurately and completely. This includes providing their name and address, Social Security Number, and other required information. Taxpayers should also make sure to sign and date the form before submitting it to the requesting entity. The W-9 form is an important document that taxpayers should use to provide the necessary information to tax authorities or employers. The printable version of the W-9 form allows taxpayers to print the document on demand, save it for future use, and complete the form without any mistakes. Taxpayers should obtain the form from the IRS website or their employer, fill it out accurately and completely, and sign and date it before submitting it to the requesting entity. Fill Now

Form W-9 Printable The W-9 tax form is a document that taxpayers use to provide their tax identification information to employers or other entities for tax filing purposes. The printable version of the W-9 form is an easy-to-use way to provide the necessary information to the entity requesting it. The W-9 form includes vital features such as name and address, Social Security Number, Employer Identification Number (EIN) in case of a business, type of entity, and certification. The form also requires the taxpayer to provide their signature and the date of signature. Advantages of the printable version The advantages of using the printable version of the W-9 form include the following: being able to print the form on demand; being able to save the form for future use; being able to complete the form without having to worry about making any mistakes; the form is also easy to use and can be filled out in minutes. The W-9 form can be obtained in several ways. Taxpayers can simply download the form from the Internal Revenue Service (IRS) website or obtain the form from their employer. It is also possible to obtain the form from a tax professional or legal representative. How to fill out the W-9 form? In order to complete the W-9 form properly, taxpayers should ensure they provide all the necessary information accurately and completely. This includes providing their name and address, Social Security Number, and other required information. Taxpayers should also make sure to sign and date the form before submitting it to the requesting entity. The W-9 form is an important document that taxpayers should use to provide the necessary information to tax authorities or employers. The printable version of the W-9 form allows taxpayers to print the document on demand, save it for future use, and complete the form without any mistakes. Taxpayers should obtain the form from the IRS website or their employer, fill it out accurately and completely, and sign and date it before submitting it to the requesting entity. Fill Now